FX Markets - e.g. Vol 14 No 12

Articles in this issue

ACI postpones Beirut meeting

BEIRUT -- The biennial meeting of the forex industry organised by ACI-The Financial Markets Association, has been postponed until September 10--14, the ACI announced last week.

Payments banks in CLS lead

NEW YORK -- Banks with traditionally strong payments businesses are winning the race for CLS third-party clients, according to consultancy Capco.

Goldman down, Bear Stearns up in Q1 forex

NEW YORK -- Goldman Sachs last week reported reduced forex revenues within its fixed-income, currency and commodities (FICC) division for Q1, although other US investment banks fared better.

Regulators approve Allfirst purchase

NEW YORK -- Federal and state regulators have approved M&T Bank’s purchase of Allied Irish Banks’ US subsidiary Allfirst Financial -- the bank that last February discovered it had lost nearly $700 million from fraudulent FX trading.

BarCap lures top dealers

LONDON -- Barclays Capital is in the midst of an aggressive recruitment campaign in London and New York, targeting staff at the world’s top investment banks.

Dollar bloc upsurge boosts Australian forex turnover

SYDNEY -- Increasing interest in Australian dollar trading is boosting Australian banks’ forex turnover, senior market participants told FX Week .

War and the dollar

Near-term dollar direction will now depend on the length and ‘success’ of the war. But those factors are far from certain, says Jake Moore, FX strategist at Barclays Capital in Tokyo.

Deutsche adds to e-FX

NEW YORK -- Deutsche Bank plans to add FX options, futures and exchange-for-physical contracts to its FX electronic trading and order management platform, autobahnFX, by the third quarter.

Italian team snubs Merrill

LONDON -- A three-strong Italian FX sales team backtracked on a move to Merrill Lynch to rejoin Goldman Sachs in London last week.

CLS settlement "100% on time"

NEW YORK -- Despite some disruptions, trade settlement on the new Continuous Linked Settlement (CLS) service for FX has seen 100% ‘on-time’ performance since its September 9 launch.

BoA sells Canada corp arm

TORONTO -- FX services group Travelex has bought part of Bank of America’s corporate forex business in Canada.

Merrill to settle its forex trades via Citi

NEW YORK -- Citigroup has won a coveted deal to settle Merrill Lynch’s forex trades on its behalf on the new Continuous Linked Settlement (CLS) service for FX.

360T lures JPMC’s Mohr

FRANKFURT -- German FX technology firm 360T has hired Andrea Mohr from JP Morgan Chase in London to spearhead its sales effort.

Further uncertainty grips market

LONDON -- FX markets breathed a sigh of relief last week as the war in Iraq got under way, but as one source of uncertainty was removed, another popped up.

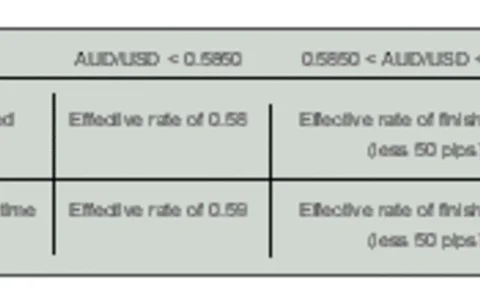

Aussie calls offer no worries hedge

Sara Sullivan, senior manager, FX options sales at ANZ Investment Bank in London, summarises an options solution for a corporate client concerned about a reversal of the AUD strength against the USD.

Strategists’ role in prop trading under focus in choppy markets

NEW YORK -- Choppy markets are highlighting the difficulties of accurately forecasting currency moves -- and no more so than for those banks with capital behind their strategists’ recommendations.