Derivatives

Growth in derivatives trading speeds up, reports BIS

BASEL – Trading on international derivatives exchanges has continued to pick up pace, according to the latest Bank for International Settlements (BIS) Quarterly Review, which was released last week.

EBS set to take NDF trading online

LONDON – Non-deliverable forwards are set to be traded electronically with EBS. The platform is in discussion with banks about making them available on the platform.

BoA boosts sales and trading

NEW YORK – Bank of America (BoA) has boosted its global FX business with three hires in New York and Singapore, it has confirmed.

Bloomberg continues FX boost

NEW YORK – Bloomberg is continuing to build up its forex capabilities with a new information product called FXIP (foreign exchange information platform).

Bloomberg continues FX boost

NEW YORK – Bloomberg is continuing to build up its forex capabilities with a new information product called FXIP (foreign exchange information platform).

There are no options benchmarks

The following is a case study of option volumes with delayed delivery, by Nasir Afaf, global head FX options, Commerzbank Corporates & Markets in London

HSBC names Brown global FX chief

GLOBAL – HSBC has undergone a major reorganisation in FX, resulting in a newly created global head of FX role.

Tullett Prebon sets up volatility division

LONDON – Tullett Prebon has established a volatility division, in the final stage of restructuring since parent company, Collins Stewart Tullett, acquired Prebon Yamane in 2004.

Hong Kong set for retail yuan NDF contracts

HONG KONG – Authorities in the Special Administrative Region are to follow China's lead in making renminbi non-deliverable forwards (RMB NDFs) available for trading next month.

Interactive to switch FX feed

BEDFORD, MASSACHUSETTS – Data vendor Interactive Data is to switch off an old forex data feed from its ComStock division and replace it with a new one from another part of ComStock, GTIS.

Using probability for barrier placement

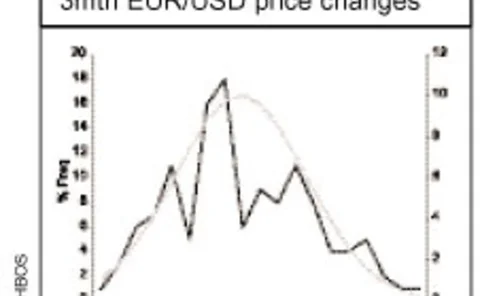

Mark Miklavs, director, structured derivatives at HBOS treasury services in London, develops an option hedging strategy to take advantage of the recent pick-up in volatilities by using normal distribution to provide a theoretical perspective on barrier…

A cheaper way to take a bearish stance

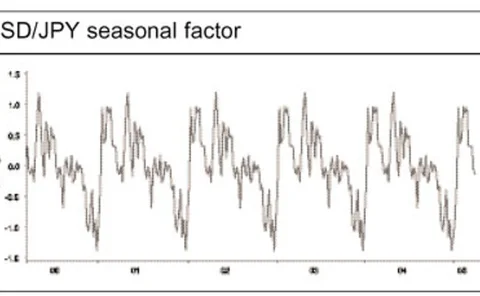

Ian Stannard, senior currency strategist at BNP Paribas in London, suggests using an anticipated short-term recovery to significantly reduce the cost of entering a longer-term bearish strategy on USD/JPY

SG CIB rolls out cross-asset research

PARIS – Société Générale Corporate & Investment Banking (SG CIB) has introduced cross-asset research to meet demand for information resulting from the increased correlation and interaction between asset classes from investors.

AUD/USD hedge for an uncertain outlook

With an uncertain short-term prognosis for the AUD/USD, Sara Sullivan, senior manager, financial engineering at ANZ Bank in London, explains a structure that offers downside protection against a stronger Aussie while allowing unlimited upside potential…

Further boost for Asian forex volumes

HONG KONG – Asia’s forex markets will continue to see strong activity this year as more participants pile into the asset class.

Hedging Chinese renminbi revaluation

To boost returns on the event of Chinese renminbi revaluation, trading on the recently launched Bloomberg-JPMorgan Asian Currency Index (ADXY) is the best solution, says Erik Herzfeld, head of regional options trading at JP Morgan in Singapore, and…

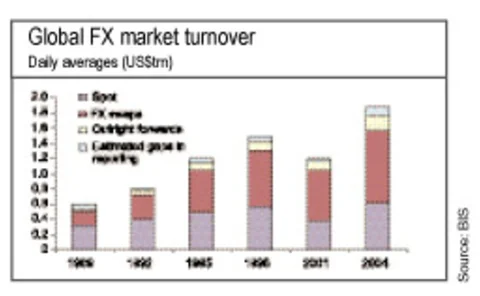

BIS paints bright future for FX

BASEL – The huge growth in daily turnover in the global foreign exchange market, revealed in the Bank for International Settlements’ (BIS) triennial FX survey last week, has painted a bright future ahead for forex market participants.

NDFs for a company with operations in China

Clients based in one country with manufacturing bases in another are exposed to risk if the country of production’s currency appreciates. Here, Ashish Advani, director, risk solutions at Travelex in London, proposes a solution that hedges the risk using…

Protecting speculative trade management positions

Some clients will have specific views on the future movements of currencies to which they have exposure. UBS's global FX solutions group shows how barrier strategies can be used to limit risk on these positions

Rivals gear up for FX clearing

LONDON – The stage is set for a central counterparty clearing (CCP) system for FX as two potential providers moved their plans forward last week.

Year of plenty for top 30 banks

Little evidence of mid-tier contraction as revenue ranking hits new high

Kemp takes FX helm at Merrill

NEW YORK – Morgan Stanley FX chief Stephen Kemp is set to take on the continued build-up of Merrill Lynch’s forex business, following the resignation of co-head of global FX and rates Michael DeSa.

Profiting from the Chinese yuan

With speculation rife on the revaluation of the Chinese yuan, James Davison of the global FX derivatives marketing team at ABN Amro in London, examines potential ways for derivatives traders to benefit

The zero-cost double KO/KI forward

A double knock-out/knock-in forward may provide a Mexican manufacturer with an effective zero-cost hedge, say Vincent Lee and Richard Stang, vice-presidents in FX sales at TD Securities in Toronto