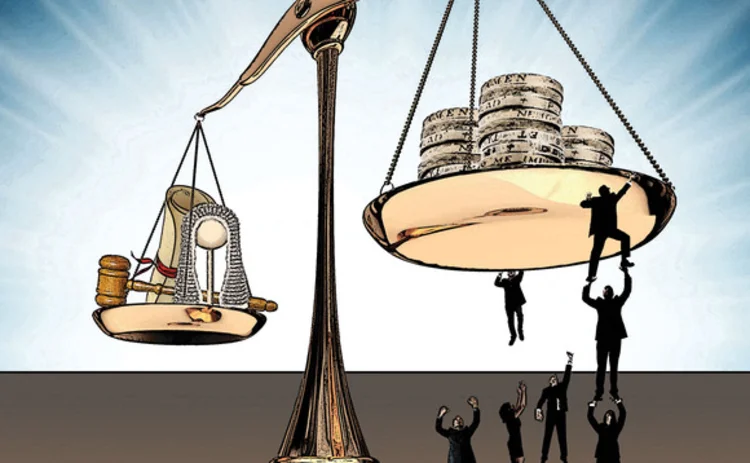

Banks weigh up CCPs as clearing deadline looms

In just a few months' time, foreign exchange traders will be faced with a new reality in which some products will need, by law, to be cleared through central counterparties (CCPs). The rules have been a long time coming, and there is clear variation in the preparedness of different firms, but market participants are stepping up a gear to make sure they are ready to clear through CCPs when required.

Clearing of non-deliverable forwards (NDFs) – the first FX product expected to be mandated for

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact customer services - www.fx-markets.com/static/contact-us, or view our subscription options here: https://subscriptions.fx-markets.com/subscribe

You are currently unable to print this content. Please contact customer services - www.fx-markets.com/static/contact-us to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@fx-markets.com

More on Regulation

European funds face upsurge in settlement risk after T+1

Trade body Efama finds up to 40% of daily FX flows may have to settle outside protection of CLS

Basel Committee prepares crackdown on bank ‘window dressing’

Study says lenders have obscured their true systemic importance at reporting dates

Emir 3.0 threatens lag for Simm revisions

New EU rules could stall changes aimed at improving risk sensitivity of industry margin models

US dealers slam capital hit on clearing for unreal CVA risk

Fed would diverge from Basel standards by imposing CVA capital on client-cleared trades

In a world of uncleared margin rules, Isda Simm adapts and evolves

A look back at progress and challenges one year on from UMR and Phase 6 implementation

Dealers braced for Taiwan swaps clearing mandate

Expected FSC directive on TWD interest rate swaps could spur growth in FX clearing, say bank execs

Clearing members fear CFTC bending rules for crypto

Critics warn new framework for Bitnomial and LedgerX could undermine clearing integrity

Regulators’ FRTB estimates based on faulty premise – industry study

US market risk capital requirements could more than double if banks abandon IMA