Volatility to remain constrained by central banks, says Rabobank

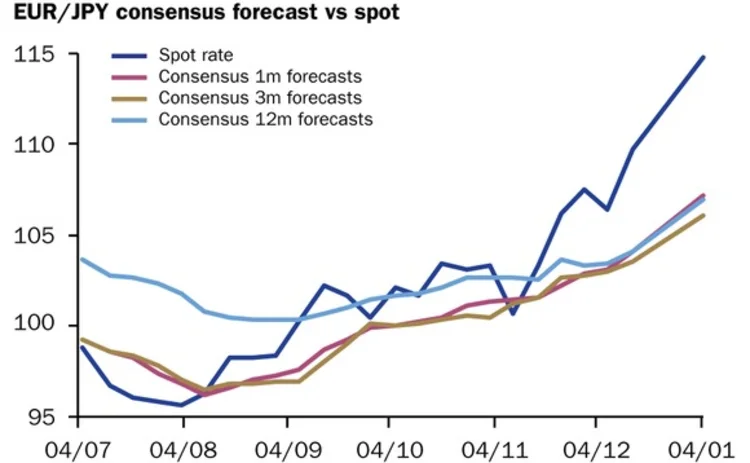

Rabobank has topped this week's 12-month currency forecast rankings after predicting at the start of 2012 that an increase in risk appetite would weaken both the US dollar and the Japanese yen.

On January 6, 2012, with USD/CHF trading at 0.95, Rabobank accurately forecast that the pair would fall to 0.93 in 12 months' time, while GBP/USD would rise from 1.55 to 1.63.

"Our weaker dollar view was from the anticipation that more quantitative easing (QE) in the US would remain a theme, helping to

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact customer services - www.fx-markets.com/static/contact-us, or view our subscription options here: https://subscriptions.fx-markets.com/subscribe

You are currently unable to print this content. Please contact customer services - www.fx-markets.com/static/contact-us to find out more.

You are currently unable to copy this content. Please contact info@fx-markets.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@fx-markets.com

More on Rankings

Gain Capital on top as market eyes Fed rate hike

US retail broker sees dollar strength continuing

RBC weak cable view lands bank top

A bearish view on GBP/USD in the last month has catapulted the Canadian bank into first place from 21st

Saxo Bank wins with long-term dollar call

John Hardy is unsure how long EUR/USD parity will last

Pick-up in volatility takes SEB to top

The Swedish bank sees EUR/USD trading at 1.08 by June

USD/JPY call pushes Nomura to top

Japanese bank moves up from sixth place

SEB wins anticipating weak USD gains

BoJ could be forced into further QE before 2015

Spot-on dollar view puts CIBC top

Fed to raise rates soon after BoE action

Euro resilience helps Monex top rankings

US dollar has not been helped by poor economic data