Opinion/Risk Management

Casting a wider net

Olaf Ransome, head of product development & support transaction services & solutions, Credit Suisse in Zurich, advocates that CLS should diversify into emerging currencies sooner rather than later

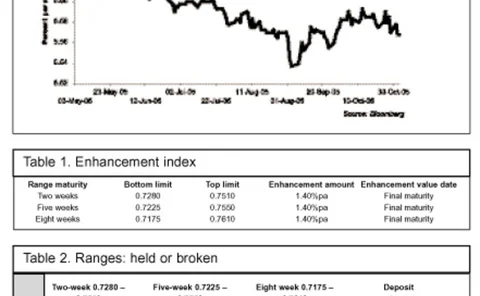

A towering rate of return

Sara Sullivan, head of currency solutions at ANZ Investment Bank in London, presents a way of enhancing returns on deposits by taking a view on exchange rates

Sign up for buy-side involvement

Olaf Ransome, head of transactions development and support at Credit Suisse in Zurich, calls on FX management to embrace plans to adopt an agreement that would make it much easier for the buy side to sign up to continuous linked settlement

Asia takes electronic currency route

Electronic currency networks are coming to the fore in Asia as daily trading volumes reach an all-time high, according to Michael Weiner, co-founder and managing partner at CoesFx

Predicting the unexpected

Extreme value theory is an effective way of predicting the large moves frequently seen in currency markets, says Collin Crownover, global head, investor risk advisory group at Citigroup in New York

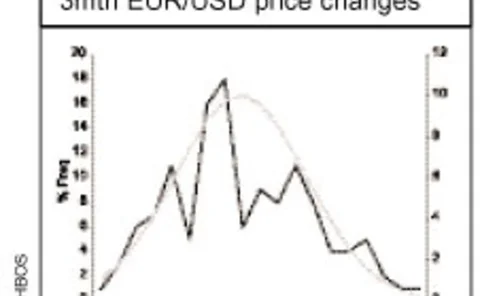

Using probability for barrier placement

Mark Miklavs, director, structured derivatives at HBOS treasury services in London, develops an option hedging strategy to take advantage of the recent pick-up in volatilities by using normal distribution to provide a theoretical perspective on barrier…

‘One size fits all’ is not appropriate

Sabrina Jacobs, FX strategist, capital markets, at Dresdner Kleinwort Wasserstein, says Asian currencies need to be looked at on an individual basis

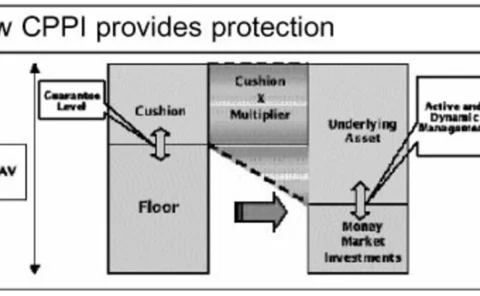

Capping downsides, tapping upsides

Jeffery Todd Lins (right), director of quantative analysis, and Peter Ager Hafez, senior research associate, at Saxo Bank, suggest a mechanism to cap the downside risk while allowing for upside potential in the absence of options on a currency fund

A broader view than the yuan

While much attention is focused on a likely shift in the value of China’s currency, Ashish Advani (right), director of risk solutions at Travelex in Toronto, points to a way of hedging against the more imminent risk of free-floating Asian currency…

More options for hedge funds

Options give hedge fund managers a tool to manage spot currency trades outside of leaving simple orders in the market. Jeff Cooper (right), vice-president responsible for sales and structuring of FX options at Bank of Montreal in Toronto, explores this…

Towards risk-free emerging markets investment

Pete Eggleston, head of quantative solutions at Royal Bank of Scotland (RBS), outlines a way of benefiting from the high yields associated with emerging market investing while controlling the inherent risk

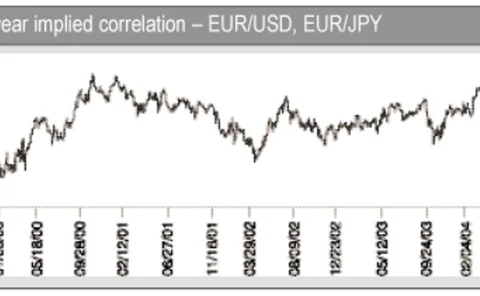

Introducing FX into fixed-income portfolios

David Durrant, chief currency strategist for the Americas at Julius Baer Asset Management, says a simple use of cross trades exploiting different central banks’ positions in the economic cycle shows that it is not necessary to use exotic structures

Soft knock-in knock-out forward

The soft knock-in knock-out forward presents a new way to look at knock-ins and knock-outs, taking away the negative impact of untimely barrier events says Enrico Ferrante, senior structurer at Calyon in Paris

Protecting against losses while making gains

Given the rapid, one-way move in the Canadian dollar (CAD), many hedgers who are short CAD are looking for innovative hedging ideas. John McAuliffe, manager, US FX options sales at the Bank of Montreal in Chicago, suggests some options

The American-style participating forward

Clients wishing to trade at a pre-specified strike rate during a certain window period, should consider the American-style participating forward, say Bank of America options specialists Jim Kamphoefner in San Francisco and Ravi Chopra in Singapore

Prime brokerage best for individual investors

Individuals who want to trade FX may find a prime broker will promote confidentiality, cut out settlement difficulties and help resolve credit issues, says Peter Wakefield, MD of research and product development at Record Currency Management in the UK

NDFs for a company with operations in China

Clients based in one country with manufacturing bases in another are exposed to risk if the country of production’s currency appreciates. Here, Ashish Advani, director, risk solutions at Travelex in London, proposes a solution that hedges the risk using…

Protecting speculative trade management positions

Some clients will have specific views on the future movements of currencies to which they have exposure. UBS's global FX solutions group shows how barrier strategies can be used to limit risk on these positions

Volatility and leverage key for Euro importer

Trading volatility allows a European importer to improve its dollar buying rate and mitigate Asian strengthening says Silash Ruparell in European FX sales at Lehman Brothers in London

Dual currency forwards to the rescue

Dual currency forwards can offer tangible benefits if used wisely, says Standard Chartered’s Charlie Brown, global head of structuring in London, and Michael Image, structurer for Northeast Asia, in Hong Kong

How to ride out the rising Aussie

The stellar rise of the Aussie doesn’t have to be bad news for Australian exporters. Wes Price, of ANZ Bank’s consultative risk management group in Melbourne, explains why