Erik Petri, head of triBalance at OSTTRA, explores how counterparty credit risk (CCR) compounds the costs of trading over-the-counter (OTC) derivatives and the maintenance of derivatives portfolios, examining the nuances of OTC credit risk management, and proposing key ways organisations can manage and optimise CCR

There are a multitude of risk factors that contribute to the cost of trading OTC derivatives and maintaining a derivatives portfolio over time. As the industry transitions to the risk-based calculation method for capital requirements – known as the standardised approach to CCR (SA‑CCR), this article examines how CCR contributes to these costs by highlighting the intricacies involved in OTC credit risk management.

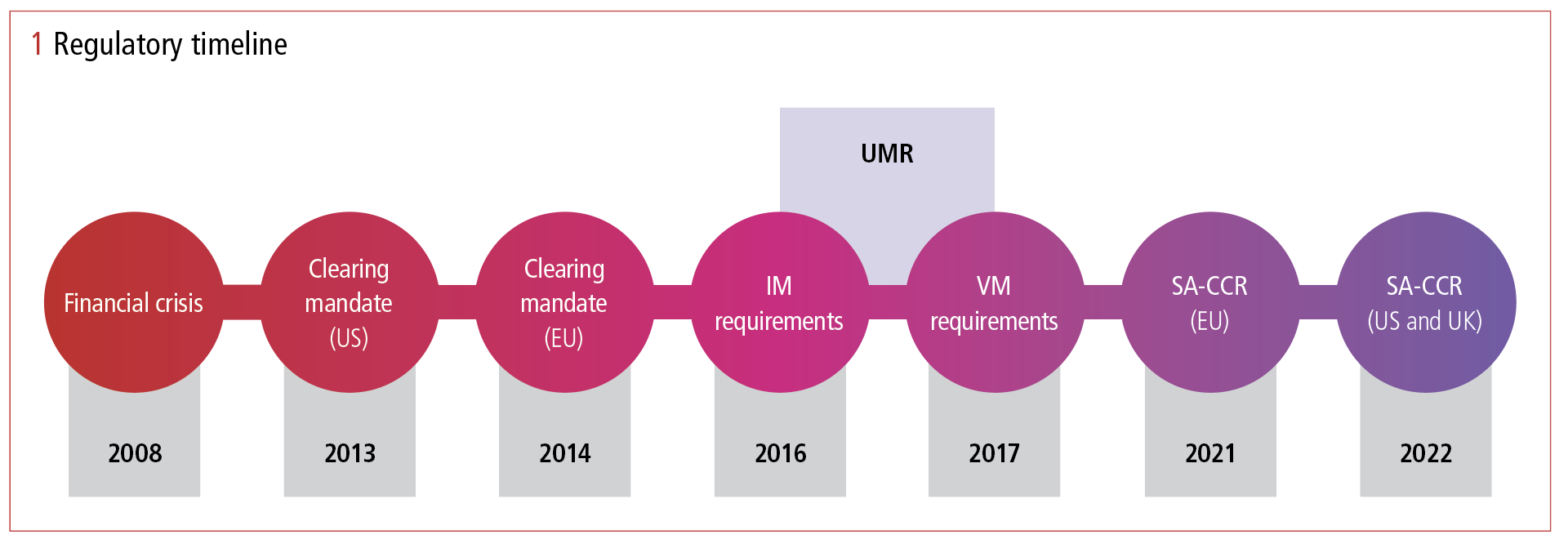

The importance of effective CCR management became evident during the global financial crisis that began in 2007–08. It subsequently became a central theme in the regulatory changes that followed, including mandatory central clearing, the requirement to secure non-cleared exposures via variation margin (VM) and initial margin (IM), and, most recently, the implementation of the updated capital regime, SA‑CCR. Over time, each of these regulatory initiatives has increased the cost of CCR, in turn incentivising effective risk management and proactive mitigation.

Mandatory clearing has made the financial markets more resilient by ensuring that liquid and vanilla risk are centralised, netted down and facing a financially robust counterparty. However, risk exposures that were traditionally intended to hedge one another but originated from different product types are scattered between different netting sets, resulting in fragmentation since not all products are eligible – or indeed suitable – for clearing.

The advent of uncleared margin

After the introduction of the mandatory clearing rule, regulatory focus switched to the mitigation of bilateral risk, with firms required to exchange margin with their counterparties. This became mandatory for the largest firms in the first wave of the uncleared margin rules (UMR) in 2016–17. UMR thrust counterparty risk back into the spotlight and the cost of funding IM has become a real consideration when maintaining an OTC portfolio.

Many of the most active FX trading participants witnessed rapid growth in their IM requirements since FX positions are typically fragmented across multiple currency pairs and counterparties, and have historically only been cleared or netted to a limited extent. The UMR product scope differentiated between FX products – specifically those with and without physical delivery. This, again, impacted well-managed netting sets as non-deliverable risk from FX instruments that attracted bilateral margin, while deliverable FX risk did not.

This encouraged the industry to reduce risk using a combination of pre- and post-trade optimisation tools, as well as promoting scalable initiatives to help achieve this. The resulting solutions optimise risk allocation between bilateral counterparties and central counterparties (CCPs), which reduces the size of margin calls and the associated funding costs. The clear benefits of these new multilateral services resulted in rapid adoption and incorporation into banks’ daily operations. These initial solutions were very efficient, given the focus was purely on CCR, and left market risk unchanged. In FX products alone, the cost savings achieved through the optimisation of credit risk amounts to savings exceeding $100 million annually (see figure 1).

Adoption of the SA‑CCR capital regime

The recent introduction of SA‑CCR as the standard capital measure for calculating CCR altered the dynamics of FX credit risk again, adding another dimension to be considered when minimising the all-in cost of trading. Existing risk management and optimisation solutions have been extended to include the additional complexity, and new solutions such as selective post-trade novation, compression and clearing have been – and continue to be – analysed.

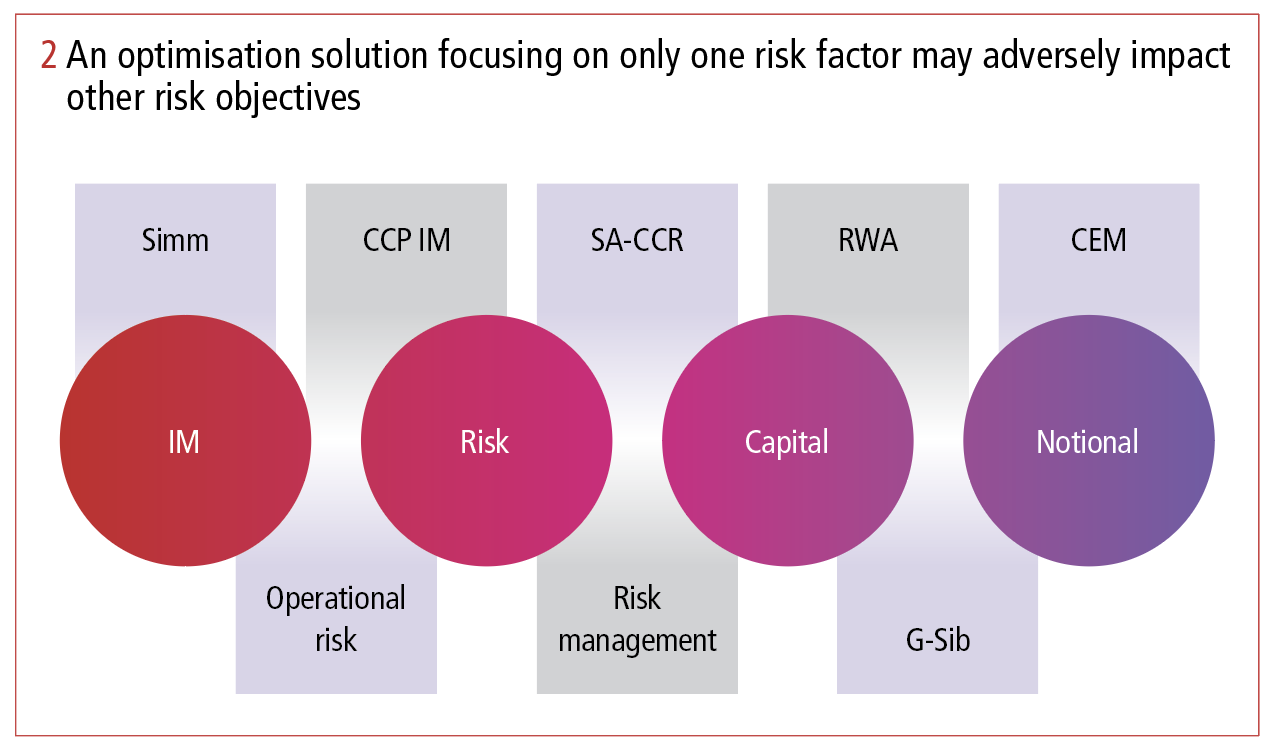

Actively managing FX exposures and counterparty risk for UMR and/or SA‑CCR, or concentrating exposures by clearing, can reduce the associated risks and costs. However, the complexity of managing multiple measures and different types of netting sets all need to be considered simultaneously if firms are to achieve the objective of minimising all-in derivatives portfolio costs (see figure 2).

UMR and SA‑CCR are both driven by CCR, and each of them affects the cost of trading FX. They are interconnected and cannot be considered in isolation – active risk mitigation in one risk measure may result in an adverse impact on the other. They need to be addressed in tandem, not only because of their similarities but also because there are some important differences that are unique to the FX market:

- Different calculation models apply, which makes the relative value of risk reduction different between SA‑CCR and UMR.

- The range of FX products included in each model differs:

- SA‑CCR covers all FX exposures and includes cross-currency risk

- UMR exempts all deliverable FX risks and classifies cross-currency differently.

- Legacy trade populations are treated differently:

- SA‑CCR covers all exposures irrespective of trade date

- UMR only applies to positions traded after each firm’s respective UMR implementation date.

- The exposure thresholds applicable to UMR imply that exposures below a certain level do not trigger any margin calls – and therefore costs – while all SA‑CCR exposures require capital to be reserved.

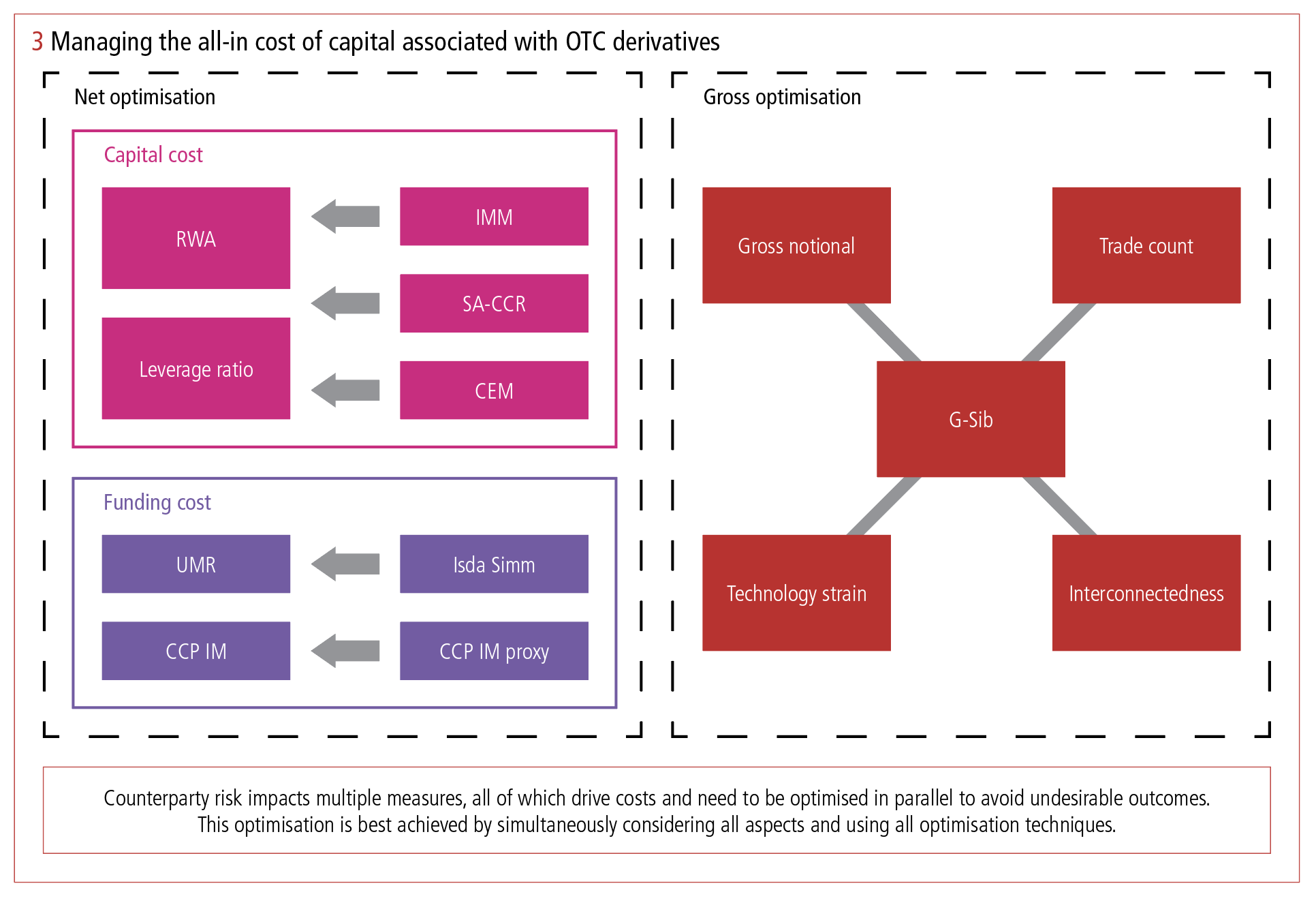

- Capital regulations in certain jurisdictions include a floor – for example the Collins floor for risk-weighted assets (RWA), calculated using the internal model method (IMM) which impacts the relative value of managing UMR, SA‑CCR and IMM exposures (see figure 3).

FX exposures can, for the benefit of UMR and SA‑CCR or IMM, be simultaneously and independently optimised by leveraging the differences in instrument coverage. Clearing increases netting efficiency, reducing the size of outstanding exposures while causing deliverable FX transactions to attract additional margin requirements. These incremental costs must be considered when seeking to optimise the all-in cost of maintaining FX exposures via redistribution of counterparty risk, clearing or novation.

These methods can all be used in isolation, but the best outcome is achieved when applied together to optimise and minimise the all-in cost.

Although some of these properties are specific to the FX market, others are common across asset classes. In interest rate markets, for example, mandates have driven the majority of trades into clearing and the instrument scope for the standard initial margin model (Simm) and SA‑CCR is the same – thus the optimisation characteristics differ from the FX market.

There are also differences specific to individual firms that can be highlighted, and are important to consider when seeking to actively manage risk to reduce the all-in cost of CCR:

- RWA calculation using the standardised approach versus IMM

- The same risk weight facing all counterparties versus different risk weights, depending on counterparty

- Potential floor for IMM calculation of RWA capital requirements

- Leverage ratio versus RWA as constraining capital adequacy ratio

- Individual firms’ costs of funding margin versus the cost of capital impact the value of optimising UMR/CCP IM versus SA‑CCR/IMM.

Summary: significant complexity

The regulatory regime that governs CCR contains multiple interdependent measures, applying to similar exposures, which must be considered in totality to avoid an undesirable outcome.

In reality, banks and firms are domiciled in different jurisdictions, have varying levels of portfolio complexity, and have different funding costs. All of these factors must be managed concurrently when optimising CCR and regulatory costs associated with OTC portfolios.

Complexity is high. To maximise the benefit of actively managing counterparty risk, firms need to apply their own individual preferences and drivers while simultaneously accounting for differences between UMR and SA‑CCR, and bilateral and cleared exposures, for all individual asset classes.

Given that counterparties monitor risk in different ways, it is important to manage and optimise CCR:

- In a large multilateral network facing multiple counterparties

- Considering the many regulatory drivers and risk factors

- By leveraging all available optimisation techniques

- Using a process that provides maximum efficiency, repeatability and scalability.

The information in this presentation is confidential. Any unauthorised use, without the express permission of OSTTRA or any of its affiliates including TriOptima AB (“OSTTRA”), is prohibited. All logos and trademarks contained in this presentation are and remain the property of their respective owners. OSTTRA makes no warranty, express or implied, as to the accuracy, timeliness or completeness of the information, or as to the results to be attained by you or others from its use and shall not be in any way liable to recipient for any inaccuracies or omissions. You hereby acknowledge that you have not relied upon any warranty, guaranty or representation made by OSTTRA. The information herein is not, and should not be construed as, an offer or solicitation to sell or buy any product, investment, security or any other financial instrument or to participate in any particular trading strategy. Without limiting the foregoing, OSTTRA shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence, under warranty, under statute or otherwise), in respect of any loss or damage suffered by any recipient as a result of or in connection with any information provided, or any course of action determined, by it or any third party, whether or not based on any information provided. Your sole remedy for dissatisfaction with the information herein is to stop using it and this limitation of relief is a part of the bargain between the parties. You agree to indemnify, defend and hold harmless OSTTRA from and against any claim, action or demand, including, without limitation, reasonable legal fees, made by any third party against OSTTRA due to or arising out of your use of the information.

TriOptima is regulated by the Swedish Financial Supervisory Authority for the reception and transmission of orders in relation to one or more financial instruments. TriOptima is registered with the US National Futures Association as an introducing broker. TriOptima materials are directed to Eligible Counterparties and Professional Clients only and are not intended for Non-Professional Clients (as defined in the Swedish Securities Market Law (lag (2007:528) om värdepappersmarknaden)) or equivalent in a relevant jurisdiction.

TriOptima holds a permit under Section 49A of the Israeli Securities Law; however, TriOptima’s operations are not subject to the supervision of the Israel Securities Authority. This permit does not constitute an opinion regarding the quality of the services rendered by the permit holder or the risks that such services entail. TriOptima’s services are designed exclusively for Qualified Investors in accordance with Israeli law.

Copyright © 2022 Osttra Group Ltd. All rights reserved.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@fx-markets.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@fx-markets.com