Settlement Risk

Canadians join State Street's e-commerce settlement service

BOSTON – State Street Global Markets signed up the big five Canadian banks to its settlement and confirmation matching tool for FX last week.

US banks hit by flat trading

New York – Poor market conditions have led to a sharp fall-off in FX revenues for some US banks, but others managed to post increased returns in the third quarter.

SIBOS 2004

CLS rules the roost at Sibos

Indian forex settlement service joins CLS

MUMBAI – Indian FX settlement service the Clearing Corporation of India (CCIL) will go live on CLS on October 23.

US banks hit by flat trading

New York – Poor market conditions have led to a sharp fall-off in FX revenues for some US banks, but others managed to post increased returns in the third quarter.

Special Feature - CLS settlement: the next two years

As CLS enters its third year, Joseph De Feo discusses plans for expansion Two years ago, the CLS Group launched the world's first global settlement service for foreign exchange trades. Following several other aborted efforts to tackle Herstatt, or…

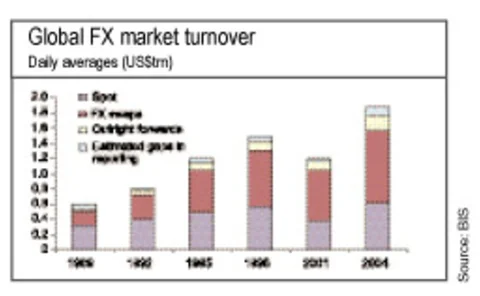

BIS paints bright future for FX

BASEL – The huge growth in daily turnover in the global foreign exchange market, revealed in the Bank for International Settlements’ (BIS) triennial FX survey last week, has painted a bright future ahead for forex market participants.

NDFs for a company with operations in China

Clients based in one country with manufacturing bases in another are exposed to risk if the country of production’s currency appreciates. Here, Ashish Advani, director, risk solutions at Travelex in London, proposes a solution that hedges the risk using…

Optimism ahead of latest BIS FX trade figures

BASEL – Banks are bullish about the Bank of International Settlements' (BIS) latest FX trading figures, due out in a survey this week.

South Africa comes under global focus

JOHANNESBURG – South Africa is currently a focus of activity in the FX world, as global institutions such as the Continuous-Linked Settlement Group (CLS) and spot broker EBS add the region to their sphere of activity.

FX volumes up by a third

LONDON – FX trading volumes are up by nearly a third over the past three years, according to new research from UK consultancy ClientKnowledge.

Rivals gear up for FX clearing

LONDON – The stage is set for a central counterparty clearing (CCP) system for FX as two potential providers moved their plans forward last week.

Korean CLS utility opts for PAYplus

The utility through which Korean banks will use the continuous linked settlement (CLS) service for FX, has selected vendor Fundtech’s PAYplus as its core application, it said last week.

ABN Amro signs half CCIL’s members for CLS

MUMBAI – More than half of the 60+ members of Indian forex settlement service the Clearing Corporation of India (CCIL) will use ABN Amro as their provider for continuous linked settlement (CLS), the Dutch bank said last week.

Micex expands forex coverage

MOSCOW – The Moscow Interbank Currency Exchange (Micex) has launched new FX contracts in a step towards expanding the exchange-traded FX market in Russia.

ACI Congress debates future

LONDON – The European forex community gathered in London last week for the ACI European Congress hosted by ACI UK. Among the contentious issues discussed during the three-day event were operational risk, the future of the European Union and trading in…

CLS is 'changing the front-office'

LONDON – The continuous-linked settlement (CLS) service for FX trades has changed credit and trading practices among the majority of its users, reveals research from IT consultancy TowerGroup to be published this week.

BIS reports FX options surge

BASEL – FX options business increased by a massive 77% year-on-year in the second half of last year, according to Bank for International Settlements (BIS) statistics released last week.

Central counterparty clearing on the way

LONDON – LCH.Clearnet is planning to launch the first central counterparty clearing service for foreign exchange, in a move that could challenge the role of continuous-linked settlement (CLS).

Calyon names regional managers

PARIS -- Calyon, the group to be formed from the merger of Crédit Agricole Indosuez (CAI) and Crédit Lyonnais (CL) on April 30, has agreed the structure of its global spot FX business and appointed regional heads, a senior official said last week.

SSiSearch adds 10 more for system testing

LONDON -- SSiSearch, a vendor of authenticated FX settlements reference data, said last week that 10 new clients are set to start testing the system, bringing the total number of banks now in trial with its global directory to 275.

CLS processes first custodian trade

LONDON -- CLS Bank International, the repository bank for the continuous-linked settlement (CLS) service for FX, settled its first custodian trade on February 13.

CAI, CL chiefs share top posts

PARIS -- Crédit Agricole Indosuez (CAI) and Crédit Lyonnais (CL) executives will share the management of foreign exchange after the two banks’ merger on April 30, it emerged last week.

US holiday helps set record volumes on CLS and CME

NEW YORK/CHICAGO -- Record volumes were set on the continuous-linked settlement (CLS) service for foreign exchange, and on the Chicago Mercantile Exchange’s (CME) e-FX platform last Tuesday (January 20) after the US holiday the preceding day.