United States dollar

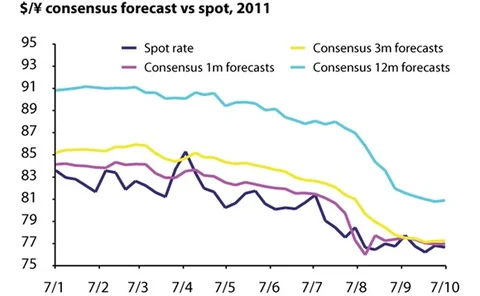

Why the consensus is wrong on USD/JPY

RBC Capital Markets has taken a contrarian view on the yen for several years, predicting it would strengthen against the US dollar while the consensus forecast was for yen strength. After the bank’s contrarian view has proved accurate, Adam Cole argues…

Getting it right on Swiss franc strength

Rabobank, Westpac and Bank of Montreal scoop the awards for their forecasts on USD/CHF, having correctly anticipated the impact of the Swiss franc's safe-haven status on its strength

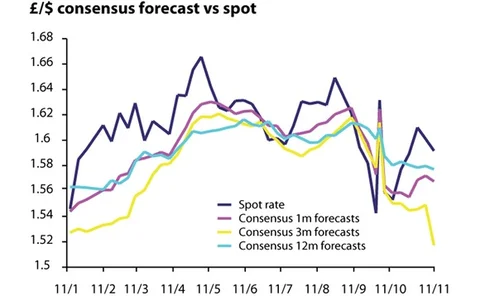

Tracking the effects of QE on cable

Commonwealth Bank of Australia, Wells Fargo and Standard Chartered take top position for GBP/USD forecasts through accurate analysis of the effects of central bank policies on the two currencies

Dollar weakness view lands Thomson Reuters on top

Thomson Reuters - IFR Markets took a view in November 2010 that GBP/USD would reach 1.6 and USD/CHF would reach 0.9 in a year's time, accurately reflecting spot rates last week

Exploring relative value

A rebound in risk assets in late October appears to have been short-lived and the foreign exchange market continues to be affected by lower-then-expected growth and a swinging pendulum between risk-on and risk-off. Callum Henderson argues relative value…

Political crisis in Europe brings volatility back to FX options

Volatility returned to eurodollar last week as FX traders priced further downside risk into euro options

Spotlight on: Collin Crownover, SSgA

State Street Global Advisors’ head of currency management talks to Joel Clark about investor appetite for G-10 and emerging market currencies, and how his global team has managed the volatility and political uncertainty that has characterised the foreign…

Japanese corporates count costs of further yen strength

Japanese companies have been hit hard by the strength of the yen and are now revising down their profit forecasts in anticipation of further appreciation

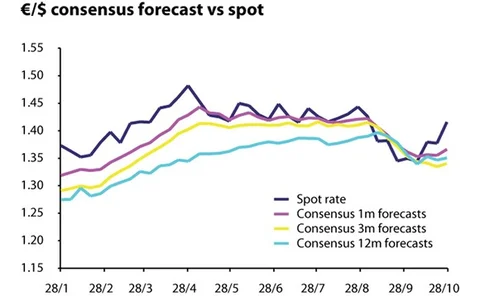

UniCredit hits top with spot-on euro forecast

Strategists at the Italian bank took an accurate view at the end of September that EUR/USD would rise to 1.40, landing it at the top of the one-month rankings

Private investor demand for FX on the rise, say managers

Volatility in major currency pairs and concerns over the US dollar have led to an up-tick in demand for FX exposure from high-net-worth individuals, according to several currency managers

Eurozone deal brings relief in FX spot and options

Risk sentiment appeared to make a comeback in FX markets yesterday as options volatility fell from record highs and the euro rallied in response to the deal announced after the Euro Summit in Brussels

EUR/CHF options market springs into life

Traders report sustained levels of activity in the five-year EUR/CHF options market as hedgers protect against long-dated downside risk

Pace of renminbi appreciation will slow, says Deutsche

Jens Scharff-Hansen, co-head of FX and short rates trading for Asia at Deutsche Bank, talks to Farah Khalique about the growth of offshore renminbi trading, recent dislocations in the onshore and offshore markets and how corporates can take advantage

Contrarian long-term view on yen strength lands ANZ on top

Australian bank predicted in October 2010 that USD/JPY would fall to 75, accurately reflecting the unwavering strength of the yen in 2011

G-10 troubles fuel sell-off in EM currencies

Declining risk appetite and a flight to quality have driven a sell-off in some emerging market currencies and pushed up the cost of hedging, say participants

Central banks shy away from euro reserves

New data from the IMF’s currency reserves database suggests reserves accumulation has slowed during 2011 and the appetite to hold euro reserves has also waned, particularly on the part of emerging market central banks

Clearing of Chilean NDFs hampered by netting uncertainty

The Central Bank of Chile has the authority to stop financial institutions netting down their transactions, which participants fear might prevent central counterparties from being able to clear contracts denominated in the Chilean peso

The Canadian dollar: to hedge or not to hedge?

The Canadian dollar weakened significantly against the greenback in the last two weeks of September, moving from parity on September 21 to 1.0461 on September 30. Farah Khalique talks to currency strategists about what’s driving the Canadian dollar’s…

Eurodollar will continue to fall, claims Saxo

A three-month forecast that EUR/USD would fall to 1.35 puts Saxo at the top of this week’s rankings, but the Danish bank sees further euro depreciation ahead

A new safe haven?

As G-7 economies start to look more volatile than some emerging markets, Nikki Marmery investigates whether the new rash of emerging markets indexes could offer some respite

Prediction of yen stagnation puts UBS on top

Accurate view on USD/JPY lands Swiss bank at the top of the one-month forecast rankings

Central banks take aim at dollar-funding shortage

Co-ordinated action from five central banks eases the pressure on dollar funding for European banks, but EUR/USD cross-currency basis swap market remains under stress

A view from the buy side: Calpers

Volatile markets have posed challenges for participants in the FX market across the globe. Eric Busay, portfolio manager at Calpers, talks about the Swiss franc, US dollar and regulatory change. By Farah Khalique

CME Chilean peso clearing service awaits first trade

The CME says FCMs are the reason for the delay in offering its clearing service of non-deliverable forwards in USD/Chilean peso