Structured Products

UBS holds onto pole position

LONDON – UBS is the top-rated bank in FX, according to the 1400 voters in FX Week's 10th annual survey of the market.

New retail laws spark alarm in Japan

TOKYO – A debate is raging in Tokyo over the impact new retail FX trading laws will have on the developing market.

Hedging Chinese renminbi revaluation

To boost returns on the event of Chinese renminbi revaluation, trading on the recently launched Bloomberg-JPMorgan Asian Currency Index (ADXY) is the best solution, says Erik Herzfeld, head of regional options trading at JP Morgan in Singapore, and…

Yield enhancement for European investors

Polish investors anticipating zloty strength over the coming year should consider a 'zloty bull note' to provide higher returns than a one-year deposit, says Andy Kaufmann, head of FX structured products for Europe, the Middle East and Africa at Merrill…

Making the most of upcoming volatility

For the currency overlay manager looking to take advantage of a burst of market volatility at the start of the fourth quarter, Simon Derrick, head of Bank of New York's currency strategy team, describes a simple, low-cost way for them to express their…

Protecting speculative trade management positions

Some clients will have specific views on the future movements of currencies to which they have exposure. UBS's global FX solutions group shows how barrier strategies can be used to limit risk on these positions

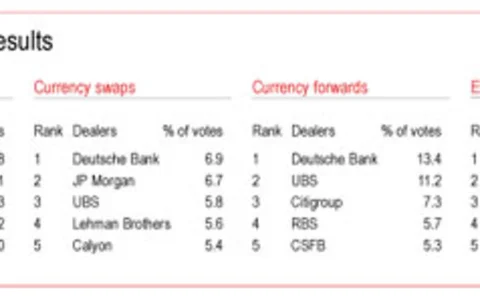

Rankings reveal diversifying inter-dealer market

The inter-dealer market for foreign exchange is shrinking, as an increasing number of mid-tier players retreat from market-making to become clients of the top firms. The banks that remain are working hard to consolidate their positions as liquidity…

Eliminating foreign exchange translation risk

FX translation can mis-represent a company's profit growth on its balance sheet. Cliff Bayne, senior exotics dealer, and Terence Yiu, chief dealer, at ABN Amro in Singapore, explain how to hedge the translation risk at minimal cost

Hedging when the market moves against you

A nine month sliding forward structure can help your company achieve attractive FX hedging rates when the market has moved substantially beyond your budget rates, says Adam Gilmour, head of FX options sales in Citigroup's emerging markets sales and…

Oil price hits Asian currencies

HONG KONG – Surging oil prices have put pressure on Asian currencies, but the impact has been magnified by other factors influencing the region, according to analysts.

Forward structure for an exotics-shy corporate

High price volatility is making EUR/AUD exposure challenging to manage. Sara Sullivan, ANZ’s senior FX options sales manager in London, proposes a solution for a European multinational that receives payments from an Australian subsidiary

AIB repays e 26m for overcharging

Customers to be repaid as regulator's report details AIB's "failures" DUBLIN – Allied Irish Banks (AIB) said it is repaying e 26 million ($32 million) it overcharged clients on three million FX deals, after a regulator slammed the bank in a report last…

Refco buys stake in ACM

GENEVA – US brokerage Refco Group bought a majority stake in online FX trading firm AC Markets (ACM) for an undisclosed sum last week. The cash purchase was completed on June 29.

How to make yen gains amid intervention fears

A currency overlay manager may wish to take advantage of fresh yen strength without being exposed to the impact of renewed intervention. Simon Derrick, head of Bank of New York's currency strategy team, describes a simple, low-cost way to express this…

Boosting dollar returns during euro strength

To boost returns on a US dollar deposit in a bullish euro environment, a European exporter would be wise to consider an FX tarn with conversion, says Christophe Bouculat, senior FX structurer at Calyon in Paris

Improver knock-in forward for dollar bears

With the widely held belief that dollar/yen has scope to fall much further, Royal Bank of Canada's financial engineering team in London proposes a solution for a client wanting to buy US dollar forwards at more attractive rates. An 'improver knock-in…

The one-year physically settled average rate forward

Capping and flooring a daily cable fixing rate offers a UK corporate with US dollar receivables an attractive risk/reward profile for zero premium, says Selene Chong, of HSBC’s FX structuring team in London

Advanced IRB Basel II approach delayed

BASEL – The Basel Committee on Banking Supervision has said that implementation of the advanced internal ratings-based approach (IRB) for credit risk and the advanced measurement approach (AMA) for operational risk will be delayed until the end of 2007…

An average rate option to protect the budget

As euro/dollar continues its descent, Rabobank’s corporate sales desk in Utrecht suggests one way for European corporates to profit from the move

China hints strongly at yuan peg change

BEIJING – China last week gave its strongest hint yet that the yuan’s peg to the US dollar could be altered sooner rather than later.

Time is right for early barrier forwards

The high level of volatility in the market makes this an opportune time for corporates to use early barrier forwards to hedge cable risk, says Barclays Capital’s senior FX structurer in London, James Edwards

MAS move could pre-empt peg changes

SINGAPORE -- The Monetary Authority of Singapore’s surprise move last week towards a "policy of modest and gradual appreciation" for the Singapore dollar may be a pre-emptive move to counter Asian peg revaluations.

JPMC fund trio make £55m

LONDON -- Three FX and fixed-income specialists who left JP Morgan Chase to set up a hedge fund have made profits of more than £55 million ($100 million) in their first year.

JPMC fund trio make £55m

LONDON -- Three FX and fixed-income specialists who left JP Morgan Chase to set up a hedge fund have made profits of more than £55 million ($100 million) in their first year.