Bank of England

A man of standing: Michael Cross, BoE

During nine years in the markets division of the Bank of England, including three years as head of foreign exchange, Michael Cross has been at the forefront of the central bank’s response to the financial crisis. As chair of the FX Joint Standing…

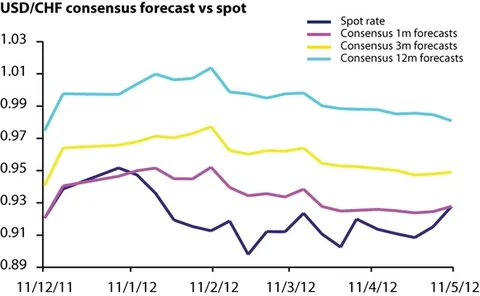

SEB rises in rankings as Swiss franc falls

SEB accurately forecast that Swiss franc would weaken against the dollar in its mid-April forecasts, putting the Swedish bank at the top of the one-month rankings

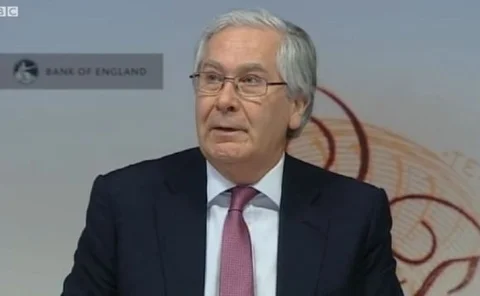

BoE’s King says eurozone is ‘tearing itself apart’

Latest Inflation Report from the Bank of England lowers growth estimates for the economy; King says situation in eurozone continues to put pressure on the UK

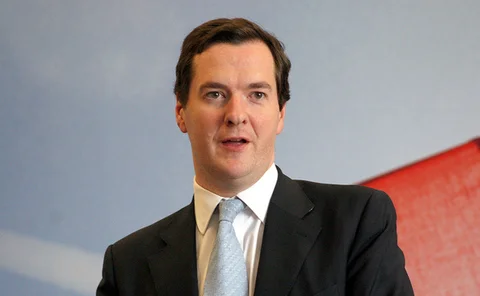

City’s top brass throws weight behind London RMB initiative

London will become the next offshore centre for RMB trading, vows UK chancellor George Osborne, supported by banking chiefs from Bank of China, Barclays, Deutsche Bank, HSBC and Standard Chartered

Guidance on central bank risk management is needed, says BoE’s Fisher

The Bank for International Settlements should provide guidance on best practice for central bank risk management, says the Bank of England’s Paul Fisher

Euro crisis could cause full EU break-up, warns ex-BoE official

John Gieve, former deputy governor for financial stability at the Bank of England, warns of an "explosion" waiting to happen in the EU

Trading places, March 12, 2012

New appointments at Société Générale and CIBC, as JP Morgan's prop trading head departs

Buy the Indian rupee, says State Street Global Advisors

Having been bearish on the rupee for several years, the firm's head of currency management has become more positive in recent months, and now rates the currency as a top EM bet

Yield makes a comeback

Two months into 2012, Mitul Kotecha assesses the modest healing process that appears to have taken hold in currency markets after a period of marked risk aversion, and explains why yield is becoming a key factor influencing investor appetite

FX volumes set for more modest rise in October 2011 survey results

The 23% rise in UK turnover in April 2011 was a one-off, according to market participants, but further increases expected in October 2011 survey results

Bank of England sets out code of practice on electronic trading

Members of the FX Joint Standing Committee comment on the recently reviewed Nips code, which includes a new section on electronic trading

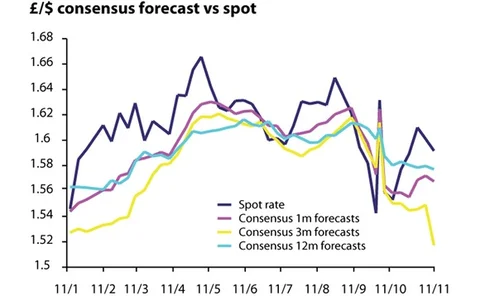

Dollar weakness view lands Thomson Reuters on top

Thomson Reuters - IFR Markets took a view in November 2010 that GBP/USD would reach 1.6 and USD/CHF would reach 0.9 in a year's time, accurately reflecting spot rates last week

Nomura loses chief economist

Peter Westaway, former head of the Bank of England's research division, has resigned from Nomura

Sterling: hamstrung by the latest round of QE?

With the announcement from the Bank of England on October 6 of a further round of quantitative easing, the consensus view of contributors to FX Week’s currency forecast index is that cable will remain around 1.55 for the next three months, despite being…

Central banks take aim at dollar-funding shortage

Co-ordinated action from five central banks eases the pressure on dollar funding for European banks, but EUR/USD cross-currency basis swap market remains under stress

Options traders sense SNB running out of steam

Options traders are betting on further appreciation of the Swiss franc, following comments from the Swiss economy minister that Switzerland will have to put up with a strong currency

The rise and rise of retail FX

Questions were raised in July when the Bank of England’s FX joint standing committee revealed a jaw-dropping 23% increase in UK turnover between October 2010 and April 2011. Among a number of drivers contributing to the increase, the most notable is the…

Yuan set for reserve currency status, Bloomberg finds

Respondents to a foreign exchange market survey cite quantitative easing, reserve currencies and regulation as their top priorities

Charitable sector gets savvy in FX hedging

Investment managers that serve the not-for-profit sector say charities have become more sophisticated in hedging their currency risk after experiencing increased volatility. How do charities typically hedge their FX risk? Chiara Albanese reports

Posen reveals Bank MPC at odds over fiscal policy

Bank of England rate-setter Adam Posen talks of divide over fiscal retrenchment; accuses majority view of being “excessively political”

Pension funds boost investment in FX

Pension funds are increasingly investing in FX as an asset class, said Thanos Papasavvas, head of currency management at Investec Asset Management, at last Tuesday's (November 16) FX Week Europe conference in London.

BoE: High-frequency traders raise risks of liquidity event

The foreign exchange market needs to address the increasing role of high-frequency traders as market-makers to insure against a liquidity event, says Michael Cross, head of the foreign exchange division at the Bank of England (BoE).

UK banking commission moots reforms

Commissioners stress they have an open mind as to which structure will best suit British banking industry

BIS must fix data gaps: Bank of England paper

Bank of England paper identifies specific information gaps in cross-border banking statistics published by Bank for International Settlements; improvements thought to be under way