Structured Products

Bloomberg enters FX options market

NEW YORK – Bloomberg is continuing to build up its portfolio of FX tools with the planned introduction of FX options trading.

UBS to build post-trade hub

ZURICH – UBS is to set up a single portal to enable all post-trade processing across different asset classes to go through one centre.

When is it appropriate to use average rate options?

Corporates can fall into the trap of using average rate options as a cheaper alternative to European options. Jeff Cooper (right), vice-president, foreign exchange, Bank of Montreal in Toronto, clarifies the misconception

UBS reaps distribution rewards

STAMFORD – UBS is seeing strong take-up for dual currency deposits (DCDs) by US retail clients after launching the product for the US market earlier this year.

Structured products in the spotlight

WASHINGTON, DC – Concerns over the mis-selling of structured products to investors in the US has prompted the National Association of Securities Dealers (NASD) to issue guidelines to ensure members fall within the scope of sales practice codes.

Platforms adopt algorithmic trading

NEW YORK – Algorithmic trading continues to gather momentum, with trading platforms EBS and Hotspot FXi linking to software provider Progress Software Corporation's Apama Algorithmic trading software.

Platforms adopt algorithmic trading

NEW YORK – Algorithmic trading continues to gather momentum, with trading platforms EBS and Hotspot FXi linking to software provider Progress Software Corporation's Apama Algorithmic trading software.

Hedging rupee currency pairs

The global markets team at ICICI Bank in Mumbai suggests ways for Indian corporates to hedge against volatility in the Indian rupee currency pairs.

CLS heads for the buy side

NEW YORK - CLS is to expand into non-deliverable forwards (NDFs) and OTC options - a move that could pave the way for far greater buy-side participation on the settlement system.

Heading for the final USD selling opportunity

Hans-Guenther Redeker, global head of FX strategy at BNP Paribas in London, suggests a way to take advantage of the prospect of near-term dollar strength to protect against the likelihood of longer-term USD weakness.

Keeping current at Currenex

In the second in a series of interbank profiles, FX Week looks at the prospects of Currenex

Protection with potential

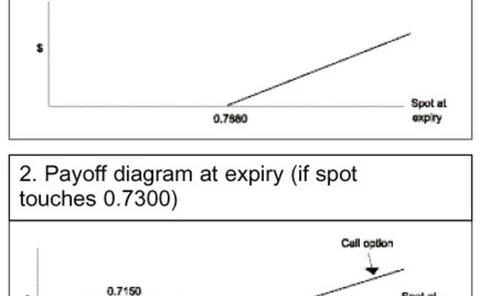

Besa Deda, Commonwealth Bank of Australia's Sydney-based currency strategist, presents a way of combining a view that the aussie will weaken while protecting against adverse fluctuations for an Australian exporter

ABN Amro cashes in on retail demand

HONG KONG – ABN Amro is capitalising on retail demand for exposure to forex markets with the launch of the first FX-linked equity notes for retail investors based in Hong Kong.

Renminbi takes first step

BEIJING – Banks are predicting further significant appreciation in the renminbi following the long-awaited shift in the currency announced last Thursday.

Relative value after the peg

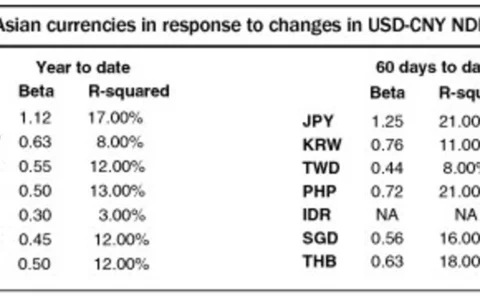

Marios Maratheftis, FX strategist with Standard Chartered in London, looks at where to find value in Asian currencies following the end of the Renminbi's dollar peg

London bomb blasts test contingencyplans

LONDON – Last Thursday’s terrorist attacks on London put the FX market’s contingency plans to the test, as explosions ripped through the heart of the global forex capital.

Using probability for barrier placement

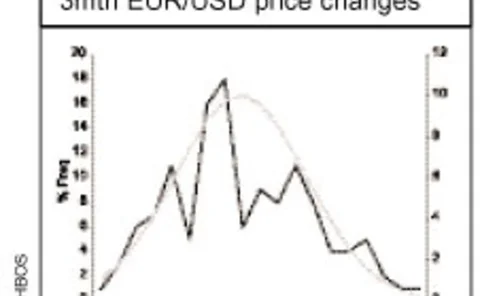

Mark Miklavs, director, structured derivatives at HBOS treasury services in London, develops an option hedging strategy to take advantage of the recent pick-up in volatilities by using normal distribution to provide a theoretical perspective on barrier…

CMC Markets adds new products and offices

LONDON/TORONTO – Online FX platform CMC Markets is set to expand with the launch of new currency baskets and additional offices globally.

EM options taking the lead

LONDON – Emerging market currencies is the biggest market for options traders, according to a survey by sister publication Risk magazine, with these units representing more than a third of the total traded.

Benefiting from yuan revaluation

The Lloyds TSB Financial Markets team suggests how to benefit if the Chinese yuan revalues and Asia follows suit

How to benefit from a weaker pound

For the currency manager looking to take advantage of fresh sterling weakness, Simon Derrick, head of Bank of New York's currency strategy team, describes a simple, low-cost way for them to express their view

Profiting from a renminbi revaluation

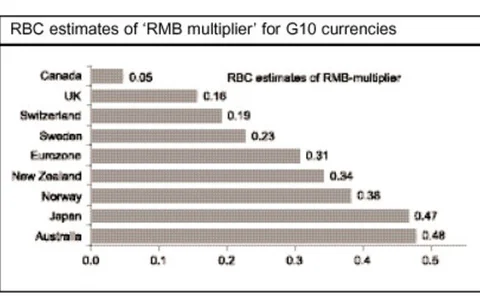

Adam Cole, senior currency strategist at Royal Bank of Canada in London, looks for options strategies to play a China revaluation within a G-10 FX portfolio

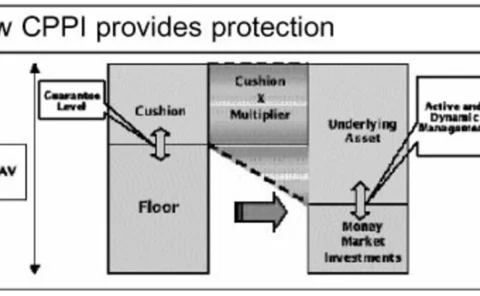

Capping downsides, tapping upsides

Jeffery Todd Lins (right), director of quantative analysis, and Peter Ager Hafez, senior research associate, at Saxo Bank, suggest a mechanism to cap the downside risk while allowing for upside potential in the absence of options on a currency fund