Structured Products

‘Extendible forward plus strategy’ for corporates with sterling exposures

Barclays Capital’s senior FX structurer, Ben McMillan, suggests an ‘extendible forward plus’ strategy to enable a corporate with a stream of sterling receipts to lock in an enhanced minimum cable rate but participate in any further moves to the upside

Currency option hedging for gold producers

Bill Nagl, Sydney-based head of ANZ Investment Bank’s consultative risk management group, looks at how Australian gold companies can hedge against a strong Aussie dollar

US pressure to bring ‘freer markets’

NEW YORK -- Active engagement between the US, China and other countries is leading towards freer markets, said John Taylor, treasury undersecretary for international affairs, last week.

Banks failing SMEs on hedging

LONDON -- More than half of UK businesses with exposure to currency transactions totalling £20 million per year are failing to hedge their exposure, according to research produced by currency services firm Travelex in the UK. The lack of protection is…

The hedge that lets you ride the wave

David Faller, Chicago-based head of FX options at BMO Financial Group in Chicago, and Evan Steed, FX options trader in Toronto, suggest a cost-effective hedging strategy to enable a Canadian exporter to fully hedge 12 months of equal US dollar…

Forward hedge overlay for euro

A Middle Eastern importer could change its risk profile by overlaying its forward hedges, says Charlie Brown, head of structuring and solutions at Standard Chartered in London. By pairing euro puts at lower levels with euro calls, the importer can assure…

All eyes on the Middle East

Growing interest in Islamic banking, new technological developments and a wave of freshly repatriated money have put forex trading in the Middle East on the cusp of an exciting new era, reports Nikki Marmery

Participating in rupee options

Following the launch of rupee options trading in India in July, Arun Khurana, head of financial markets distribution & derivatives marketing at ABN Amro in Mumbai, proposes a zero-cost 'participating forward' solution for an Indian client wanting to…

HSBC issues remittances challenge to Citi

LONDON -- HSBC last week issued a challenge to Citigroup by declaring its intention to target the $10 billion a year US/Mexican remittances market.

Basel may advise banks on outsourcing

BASEL -- The Basel Committee on Banking Supervision may investigate the risks associated with outsourcing trading systems to third parties, a senior Bank for International Settlement (BIS) official told FX Week .

Mitigating euro/krona uncertainty

FX quantitative strategist Giovanni Pillitteri and corporate risk structurer Bertrand Nortier at Deutsche Bank in London present a solution for a Swedish client to monetise flow uncertainty and participate in case of the Swedish krona weakening

A ‘worst-of’ option to hedge dollar weakness

Andy Kaufmann, FX structurer at Merrill Lynch in London, explains a solution for an investor who is looking to benefit from a USD move against a variety of currencies

Dealing with yen downside risk

A collapse in the dollar/yen could offer significant trading benefits. How should an FX trader deal with the downside risk? By John Taylor, chairman of FX Concepts in New York

Hedging solution for Canadian exporters

A series of Canadian dollar calls could be the solution to Canadian exporters’ concerns about the direction of US dollar/Canadian dollar, says Shaun Osborne chief currency strategist at Scotia Capital in Toronto

SG launches first UK currency warrants

LONDON -- SG, the investment banking arm of Société Générale, has issued the first currency warrants in the UK. This follows the release of warrants linked to oil, gold and house price moves by Goldman Sachs, SG’s biggest rival in this area.

Cheap volatility brings yen opportunities

Japanese economic growth has outstripped many western economies over the past year, and the next currency breakout in the FX markets could be yen strength. Alex Schumann and Trevor Nathan, of Commonwealth Bank of Australia in Sydney, show how investors…

Hedge optimisation under IAS39

All European Union listed companies must implement IAS 39 by the end of this year. Raymond Franzi, head of structuring, and Emmanuel Burot, head of structuring and accounting at Dresdner Kleinwort Wasserstein in London, outline how a European firm should…

Step right up for Aussie risk hedging

Fears of Australian dollar volatility could be laid to rest by a step payment option, say Paul Rhodes and Gail Sheridan, financial engineers at UBS Warburg in London.

The leveraged reverse knock-in forward

With the recent strengthening of the Canadian dollar against the US dollar, a Canadian exporter with US receivables would be wise to consider a reverse knock-in forward, says Richard Stang, vice-president in FX sales at TD Securities in Toronto

Indian market opens up

MUMBAI -- Reform of India’s FX rules could create the next large emerging market, signalling a lucrative new area for banks to exploit.

Riding with the euro

A European client buying US dollars should consider a three-year swap to use the current euro strength to their advantage, says Pritpal Gill, head of structuring at Lehman Brothers in London

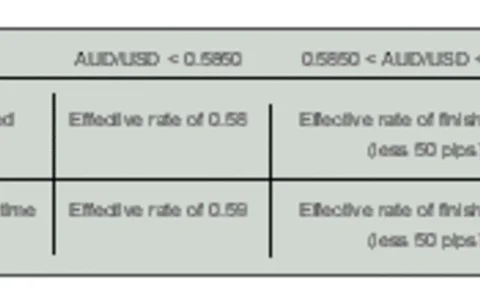

Aussie calls offer no worries hedge

Sara Sullivan, senior manager, FX options sales at ANZ Investment Bank in London, summarises an options solution for a corporate client concerned about a reversal of the AUD strength against the USD.

Real-life problems, innovative solutions

Options for euro-sceptics

RBS FiXes benchmarks with EBS

LONDON -- The Royal Bank of Scotland (RBS) has gone live with a new benchmark engine for spot and forwards FX rates, called RBSFiX.