Opinion

Risk appetite and FX positioning

Richard Franulovich, currency analyst for Westpac in New York, says weaker US data is likely to lead to a weaker dollar

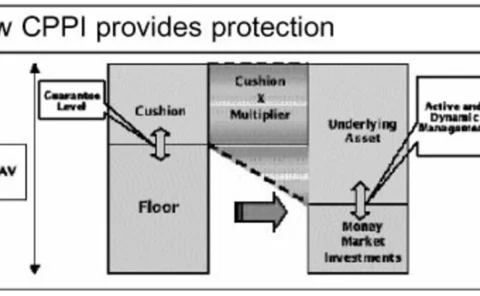

Capping downsides, tapping upsides

Jeffery Todd Lins (right), director of quantative analysis, and Peter Ager Hafez, senior research associate, at Saxo Bank, suggest a mechanism to cap the downside risk while allowing for upside potential in the absence of options on a currency fund

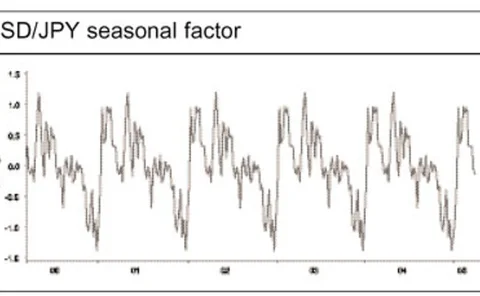

A cheaper way to take a bearish stance

Ian Stannard, senior currency strategist at BNP Paribas in London, suggests using an anticipated short-term recovery to significantly reduce the cost of entering a longer-term bearish strategy on USD/JPY

When size matters

Political risk is not a factor sterling has had to contend with recently, but the UK's general election on May 5 might see this change, says Daragh Maher, senior currency strategist at Calyon in London

What is the fate of the greenback?

Corporates need to be aware of the likely fate of the dollar. Simon Miles (below), head of dealing at London-based foreign exchange brokerage CorporateFX, points to economic policies leading to another bubble, and says the authorities need to do more to…

Reasons for rand depreciation

Tania Kotsos, senior emerging markets strategist at RBC, highlights the reasons why the South African rand should weaken over the next 12–18 months

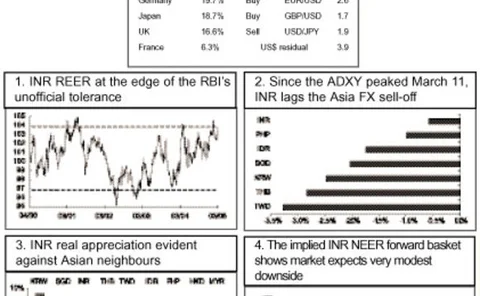

INR – everything is relative

The INR’s over-extended valuation against the Reserve Bank of India’s REER implicit policy anchor continues. This over-extension is looking anomalous against the continued backdrop of Asian FX selling. Claudio Piron, Asian FX strategist at JP Morgan in…

Best execution: not just price, but what else?

Process and practice should both be given serious attention before agreement can be reached on best execution in FX. By Chip Lowry (right), MD, Global Link Europe

Keeping a steady ringgit

Deeds speak stronger than words when it comes to the Malaysian ringgit, says Dominique Dwor-Frecaut, emerging markets strategist at Barclays Capital in Singapore

Emerging market opportunities

There are more options in emerging markets than you might think, says Scott Wacker (below), global head, client risk advisory and sales, ABN Amro in London

Oil price threat to the dollar

With FX reserves diversification and higher oil prices hitting the headlines, Simon Derrick at the Bank of New York in London discusses the potential impact on the dollar

Fade-out zero-cost collar for hedgers

Since the beginning of the year, we have witnessed a EUR/USD spot consolidation below 1.37. Also, the last move from 1.2700 took EUR-USD up to the middle of the range 1.27 / 1.37. Many USD buyers are therefore looking to zero-cost collars, one of the…

Norway looks to higher prices

The Norwegian government is pursuing policies to drive prices higher while expressing a desire for a weaker currency, says Neil Mellor, currency strategist at Bank of New York in London

Room for all providers

Contrary to much opinion in the market, Mark Warms, global sales and marketing director at FXall, says there is space in the market for all liquidity providers. He argues that hedge funds present an opportunity for the FX community

A broader view than the yuan

While much attention is focused on a likely shift in the value of China’s currency, Ashish Advani (right), director of risk solutions at Travelex in Toronto, points to a way of hedging against the more imminent risk of free-floating Asian currency…

Look to NZ for opportunities

Geoff Kendrick, currency strategist at Westpac, is focusing on the New Zealand dollar (NZD) this week

Waiting for a won u-turn

After the recent declaration that the Bank of Korea intends to employ a policy of currency diversification in its reserve holdings, the won performed strongly. Here, Bhanu Baweja, FX strategist at UBS in Singapore, looks at what could trigger a u-turn

Cutting the cost of dollar calls

With the USD having hit its lowest levels since the first half of January, Steven Englander, chief FX strategist for the Americas at Barclays Capital, suggests a cost-effective way to position for a dollar rebound

Making the most of fresh yen strength

A fresh bout of yen strength may be imminent. Simon Derrick, head of Bank of New York’s currency strategy team, describes a simple, low-cost strategy for currency overlay managers looking to take advantage of the latest moves

Dollar rebound won’t last

Less support for US currency as year goes on, says Jeff Young, head of FX strategy at Citigroup in New York

AUD/USD hedge for an uncertain outlook

With an uncertain short-term prognosis for the AUD/USD, Sara Sullivan, senior manager, financial engineering at ANZ Bank in London, explains a structure that offers downside protection against a stronger Aussie while allowing unlimited upside potential…

Expect nasty surprises

Michael Klawitter, senior currency strategist for West LB, believes the US current account deficit will remain a problem

More options for hedge funds

Options give hedge fund managers a tool to manage spot currency trades outside of leaving simple orders in the market. Jeff Cooper (right), vice-president responsible for sales and structuring of FX options at Bank of Montreal in Toronto, explores this…

Aussie momentum wanes

The Aussie will face considerable pressure around the 0.78--0.80 region, says Tim Fox, chief economist at National Australia Bank in LondonThe Australian dollar has been in strong demand since the first week of the New Year, bucking an otherwise strong…