Opinion

The US election effect

How will the US election affect the FX markets? Alan Ruskin, New York-based research director, 4Cast, reveals the results of his company's recent survey

Prime brokerage best for individual investors

Individuals who want to trade FX may find a prime broker will promote confidentiality, cut out settlement difficulties and help resolve credit issues, says Peter Wakefield, MD of research and product development at Record Currency Management in the UK

US dollar's central role

The dollar is likely to have a large role to play in the adjustment of the US economy, whether it is suited to it or not, writes Alan Ruskin, research director at New York-based analysis firm 4Cast

Dollar to continue its slide next year

Michael Klawitter, senior currency strategist at WestLB Global Financial Markets in Düsseldorf, sees the euro continuing its appreciation against the dollar next year

Hedging Chinese renminbi revaluation

To boost returns on the event of Chinese renminbi revaluation, trading on the recently launched Bloomberg-JPMorgan Asian Currency Index (ADXY) is the best solution, says Erik Herzfeld, head of regional options trading at JP Morgan in Singapore, and…

Yield enhancement for European investors

Polish investors anticipating zloty strength over the coming year should consider a 'zloty bull note' to provide higher returns than a one-year deposit, says Andy Kaufmann, head of FX structured products for Europe, the Middle East and Africa at Merrill…

SARB to cut before year-end?

Royal Bank of Canada expects a 50bp rate cut in South Africa to 7.00 before the end of the year, explains Tania Kotsos, senior emerging markets strategist at the bank in London

Oil woes hit yen

Neil Mellor, London-based analyst at Bank of New York points to the weakness of the Japanese market in the wake of high oil prices

NDFs for a company with operations in China

Clients based in one country with manufacturing bases in another are exposed to risk if the country of production’s currency appreciates. Here, Ashish Advani, director, risk solutions at Travelex in London, proposes a solution that hedges the risk using…

The 'triple-currency wedding cake deposit'

The past year has seen a dramatic surge in the use of FX-linked yield-enhancement products. Generally, these products fall into two categories: dual-currency redemption engineered by the sale of an option; and range-enhanced coupons that contain embedded…

FX majors unmoved by stronger capex

The capital expenditure recovery is unlikey to shake FX majors from their limited volatility, says Darragh Maher, senior currency strategist at Calyon

Making the most of upcoming volatility

For the currency overlay manager looking to take advantage of a burst of market volatility at the start of the fourth quarter, Simon Derrick, head of Bank of New York's currency strategy team, describes a simple, low-cost way for them to express their…

Preparing for a break from range trading

Markets have been fairly flat over recent months. How can options traders make the most of this, and how should they prepare for a break from range? By Cornelius Luca, FX Concepts' New York-based head of client advisory for the Americas

Ringgit revaluation looms

A change in the Malaysian ringgit's peg to the dollar is likely, despite the Malaysian authorities' protestations that this will not happen, says David Mann, Standard Chartered's senior FX strategist in London

The perils of a presidential election

The forthcoming US race for the White House represents a major risk for the FX markets ahead of voting in November and beyond, says Bilal Hafeez, head of foreign exchange strategy at Deutsche Bank in London

Protecting speculative trade management positions

Some clients will have specific views on the future movements of currencies to which they have exposure. UBS's global FX solutions group shows how barrier strategies can be used to limit risk on these positions

How spreads can affect profitability

Spread cost makes a big impact on profitability, says Michael Stumm, co-founder and president of Oanda. Here he shows how to assess just how much different levels of spreads cost

Will payrolls break EUR/USD range?

The market is already shifting its focus to this week's payrolls release, but the case for a range break in euro/dollar from a large positive or negative surprise is not clear cut, says Trevor Dinmore, FX strategist at Deutsche Bank in London

Will payrolls break EUR/USD range?

The market is already shifting its focus to this week's payrolls release, but the case for a range break in euro/dollar from a large positive or negative surprise is not clear cut, says Trevor Dinmore, FX strategist at Deutsche Bank in London

Eliminating foreign exchange translation risk

FX translation can mis-represent a company's profit growth on its balance sheet. Cliff Bayne, senior exotics dealer, and Terence Yiu, chief dealer, at ABN Amro in Singapore, explain how to hedge the translation risk at minimal cost

Is yen decoupling from oil?

The yen's gains against the greenback last week suggest an apparent decoupling from oil says Neil Mellor, currency strategist at Bank of New York in London

Hedging when the market moves against you

A nine month sliding forward structure can help your company achieve attractive FX hedging rates when the market has moved substantially beyond your budget rates, says Adam Gilmour, head of FX options sales in Citigroup's emerging markets sales and…

Euro/sterling kicks off

The summer football transfer season is providing unexpected support for euro/sterling, writes Pete Luxton, global markets adviser at Informa Global Markets in London

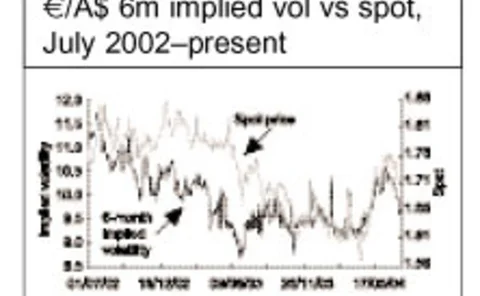

Forward structure for an exotics-shy corporate

High price volatility is making EUR/AUD exposure challenging to manage. Sara Sullivan, ANZ’s senior FX options sales manager in London, proposes a solution for a European multinational that receives payments from an Australian subsidiary