Opinion

Resetting forward solution for Korean exporters

Gail Sheridan, financial engineer at UBS in Singapore, offers a hedging solution for Korean companies looking to guard their US dollar revenues against the possibility of a strengthening won

Dollar decline likely to be over for now

Strong US data and stock market resilience point to a halt in the dollar’s decline, says Jesper Dannesboe, chief FX strategist at Dresdner Kleinwort Wasserstein in London

Mitigating euro/krona uncertainty

FX quantitative strategist Giovanni Pillitteri and corporate risk structurer Bertrand Nortier at Deutsche Bank in London present a solution for a Swedish client to monetise flow uncertainty and participate in case of the Swedish krona weakening

Candollar cartwheels

The Bank of Canada’s unexpected rate cut caused the Canadian dollar to do an about face after strengthening 13% against the US dollar in the year to date. But we can still expect Candollar strength later this year, says Lara Rhame, FX economist at Brown…

Asset sales support baht and rupiah

A wave of asset sales and privatisation in Indonesia and Thailand looks set to strengthen the Indonesian rupiah and Thai baht, says Irene Cheung (right), Asian sovereign and FX strategist at ABN Amro in Singapore

A ‘worst-of’ option to hedge dollar weakness

Andy Kaufmann, FX structurer at Merrill Lynch in London, explains a solution for an investor who is looking to benefit from a USD move against a variety of currencies

Fed reserved

For all its talk of deflation, the Fed fails to walk the walk, says Alan Ruskin, research director at 4Cast in New York

Dollar and US stocks decouple

The positive correlation between US stocks and the dollar has seen a turnaround, and this is unlikely to reappear in the near future, says Niels Christensen, senior currency strategist at SG in Paris

Protecting against euro resurgence

A Hong Kong-based firm could use a series of resetting bonus forwards to hedge against a potential euro rebound, say Charlie Brown, head of structuring at Standard Chartered Bank in London, and Mike Image, structurer for North-east Asia global FX options

Cause and FX

Corporate hedging practices have become a focal point for equity investors, as companies look beyond traditional risks. Alex Patelis, senior G-10 FX strategist at Merrill Lynch in London, highlights the risks to balance sheets from capital losses on…

Hedging solution for Canadian exporters

A series of Canadian dollar calls could be the solution to Canadian exporters’ concerns about the direction of US dollar/Canadian dollar, says Shaun Osborne chief currency strategist at Scotia Capital in Toronto

Multi-choice options for eurozone exporters

The multi-choice strategy forward option can offer flexibility to a euro-denominated exporting company looking to hedge its long-term dollar exposures, says Roman Stauss, head of FX product development at Commerzbank Securities in London

Is the dollar bouncing back?

The US dollar may have been mired in decline in recent months, but a recovery could be on the cards sooner than expected, says Tony Norfield, global head of FX strategy at ABN Amro in London

Cheap volatility brings yen opportunities

Japanese economic growth has outstripped many western economies over the past year, and the next currency breakout in the FX markets could be yen strength. Alex Schumann and Trevor Nathan, of Commonwealth Bank of Australia in Sydney, show how investors…

New Europe's FX trials

The convergence process of accession countries has been put into question. Currencies of those countries, and the Hungarian forint in particular, are likely to continue to be under pressure, say Mehmet Simsek (right) and Yianos Kontopoulos, FX…

Put the brakes on

European policymakers may have cause for concern if the recent euro rally continues, says Paul Meggyesi, senior currency strategist at JP Morgan Chase in London

Cashflow control for pension portfolio hedges

Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency Management, offers a solution to an FX-related problem facing a UK pension fund

A new crystal ball

Second-guessing the Federal Reserve is getting more complicated as the central bank enters uncharted territory, says Lara Rhame, FX economist at Brown Brothers Harriman in New York

Hedge optimisation under IAS39

All European Union listed companies must implement IAS 39 by the end of this year. Raymond Franzi, head of structuring, and Emmanuel Burot, head of structuring and accounting at Dresdner Kleinwort Wasserstein in London, outline how a European firm should…

Tale of two currencies

Recent FX market moves have exposed differing interest rate strategies for the eurozone and the UK, says Lorenzo Codogno (right), co-head of European economics at Bank of America in London

EUR-denominated diesel fuel hedge

There has been a recent trend for corporates to migrate the risk management of their commodity exposure from their procurement to their treasury departments. As the corporate’s risk is centralised, it is managed as part of a portfolio of more standard FX…

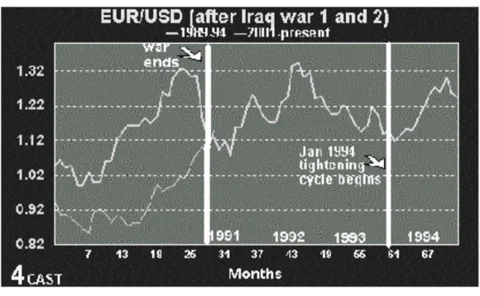

The George Jnr-George Snr divergence trade

George Bush Snr and Jnr’s presidential terms have been separated by nearly a decade. But, says Alan Ruskin, research director at 4Cast in New York, the economics on the surface look startlingly similar

Appreciating the euro

With economic conditions in the eurozone worsening, the authorities are unlikely to allow the euro’s strengthening to continue, says Mitul Kotecha, global head of FX research at Credit Agricole Indosuez in London

You have the right to remain bullish

Indonesia’s currency has offered arresting yields, while the Singapore dollar is supported by its powerful monetary authority. Further gains in both are likely, say Standard Chartered’s Claudio Piron and Marios Maratheftis.