Opinion

Sterling -- a call for calm

The market has got so excited about sterling it has failed to recognise underlying economic problems in the UK. These problems will see sterling disappoint many in 2004, say David Bloom (left) and Mark Austin, currency strategists at HSBC in London

How to ride out the rising Aussie

The stellar rise of the Aussie doesn’t have to be bad news for Australian exporters. Wes Price, of ANZ Bank’s consultative risk management group in Melbourne, explains why

Using currency as an alpha source

The past three years have been disturbing for investors and managers. This investment climate is perfect for engaging in currency strategies to create alpha, say Paul Lambert, head of currency, and Mark Pursey, UK spokesperson at Deutsche Bank Asset…

Mission impossible

Japanese FX intervention is increasing, but even unlimited funds would fail to stop appreciation, says Simon Derrick (right), head of currency research at the Bank of New York in London

Kiwi ripe to strengthen

The New Zealand dollar’s recent performance is based on more than just US dollar weakness. Sue Trinh, currency strategist at the Bank of New Zealand in Wellington, looks at what will be driving the currency in 2004

Assessing the value of e-FX trading

Predicting future currency movements is not the only problem currency managers face. Finding the best method of dealing is also an issue, explains Neil Record, chairman and chief executive officer of Windsor-based currency overlay manager Record Currency…

The year ahead in Asia

US dollar weakness and regional equity market strength look set to remain the main drivers of Asian FX in 2004, according to Tim Condon, chief economist, Asia for ING Financial Markets in Hong Kong

Hedging a short euro/dollar position

For European exporters needing to hedge exposure to the freefalling US dollar, a six-month forward may be the best solution, suggest Eric Ohayon, European head of FX structuring, and Kai Fisher, European head of FX corporate sales, at Bank of America in…

Zero-cost strategies for European importers

The strengthening euro should be a boon for European importers. Natalie Doyle, director of FX money markets and derivatives sales at ING in Singapore, explains how to make the most of the euro’s strength while hedging risks with zero premiums

The ghost of Bentsen

The lessons of history may help in assessing the dollar’s fortunes in 2004, says Peter Luxton, economic adviser at Informa Global Markets in London

The kick-knock solution for cable

Trevor Carr, manager in FX options at HBOS Treasury Services in London, suggests a creative solution for a UK parent company wanting to hedge against continuing sterling strength

More dollar pain before H2 rebound

The dollar will suffer much more pain in the near term before rebounding in the second half of 2004, says Larry Kantor, global head of economics and market strategy at Barclays Capital in New York

Euro/Swiss franc risk reversals

Simple risk reversals are the best way for Swiss investors to manage low domestic interest rates and a softening Swiss franc versus the euro, says David Durrant, chief currency strategist and senior economist for the Americas at Julius Baer Asset…

Dollar crisis? Think again

The US current account deficits are sustainable, and the dollar correction has largely come and gone, says Frank Gong, chief FX strategist at Bank of America in Hong Kong

The ratchet structure: improving with the market

With more complex options available and increasing customer sophistication, strategies in vogue are changing swiftly. David Popplewell and Richard Summerbell in RBS’s FX options structuring group in London say they are seeing a distinct shift in…

Aussie dollar nears its cyclical peak

The Australian dollar’s rally is almost over and investors should look to take profits or reduce long positions in the coming months, says Karen Pringle, senior currency strategist at ANZ Investment Bank in London.

Non-exporters still have exposure to currencies

Options could be the answer for a manufacturing company facing the twin problems of foreign competitors undercutting its prices and of the companies it supplies being less successful with an appreciating currency. Alex Barrett and Demetri Papacostas, of…

Euro/yen to trend lower

Eurozone competitiveness versus the yen has fallen sharply since a peak in 2001, and the current level of euro/yen is likely to fall again by mid-2004, says Steven Saywell (right), director of currency strategy at Citigroup in London

E-dealing requires better pricing

Efficiency gains available from technology are being undermined by pricing discrepancies, says Cognotec chairman Brian Maccaba.

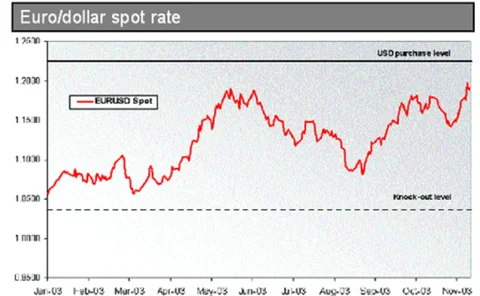

Soft Accumulator: improving hedging levels

BACKGROUND: European importers who need to buy US dollars are not complaining about the current euro/dollar rate of exchange.

Yen and the art of market cycle maintenance

The yen resurgence that began this summer is still in play. But with the Japanese authorities still sporadically intervening in the currency markets, this upward path may meet some sharp setbacks. Simon Derrick, head of Bank of New York's currency…

A strengthening yen is no barrier to Japan's exporters

A stronger yen isn't proving to be the disaster for Japanese exporters that many predicted. Tohru Sasaki, chief FX strategist at JP Morgan Chase Bank in Tokyo, looks at why a strengthening Japanese currency doesn't necessarily mean decreasing revenues…

Hedging Taiwan dollar risk

Exporters exposed to movements in the Taiwan dollar must hedge by using the non-deliverable forwards market. Michael Image, FX options structurer for northeast Asia at Standard Chartered Bank in Hong Kong, suggests a zero upfront premium solution, which…

Managing sterling risks

Trading cable or euro/sterling off fundamentals is fraught with risk because they are primarily driven by trends in euro/dollar, says Steven Englander, Barclays Capital’s New York-based chief FX strategist for the Americas. But a properly constructed…